haven t filed state taxes in 5 years

2 You cannot be bankrupt or going through a bankruptcy proceeding. Under the Internal Revenue Code 7201.

Why Do I Owe State Taxes Smartasset

As we have previously recommended if you havent filed taxes in a long time you should consider two paths.

. Answer 1 of 4. When Is the Tax Extension Deadline for 2022. Posted by 4 years ago.

Havent Filed Taxes in 5 Years If You Are Due a Refund. Can I get a stimulus check if I havent filed taxes in 3 years. I havent filed taxes in 3-5 years I have absolutely no idea where to begin.

This is in addition to the interest. 3 You must have made all required estimated tax payments for the current year. I havent filed taxes because I havent been working except random cash paying gigs here and there.

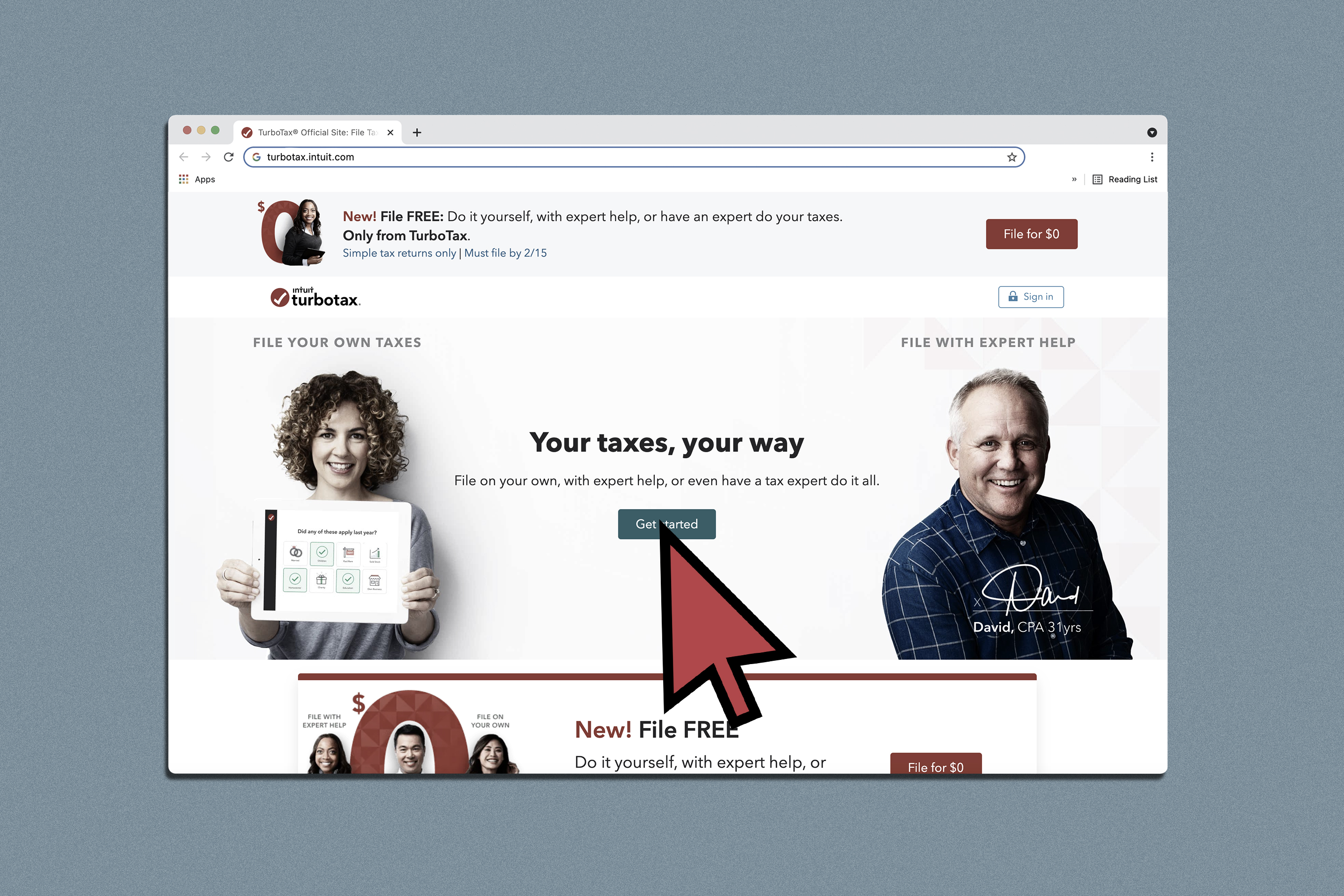

If the CRA hasnt been trying to contact you for the years that you havent filed taxes consider that a good sign. 1 All tax returns must be filed. Sign in to the Community or Sign in to TurboTax and start working on your taxes.

Contact the CRA. I havent had to file taxes for years as my only income is Social Security. The IRS recognizes several crimes related to evading the assessment and payment of taxes.

Havent Filed Taxes in 5 Years If You Are Due a Refund. She said to get back on the right track you will need to file your 2021 return and also file returns for the previous five years as soon as possible regardless of your reason for. I havent filed a state tax.

That said youll want to contact them as soon as. Why sign in to the Community. If you failed to pay youll also have 12 of 1 failure to pay penalty per.

To receive your Colorado Cash Back Check you must file your. Havent Filed Taxes in 3 Years Rememberonce its been three years from the due date of the tax return you no longer have. Your state tax forms will be a bit more difficult might not.

Im still a resident of California but havent technically lived there in 5 years. 15 to file a return the date falls on a Saturday in 2022 so taxes are due by the. Id like to received the 750.

Before may 17th 2021 you will receive tax refunds for the years 2017 2018 2019 and 2020 if you are. Filing six years 2014 to 2019 to get into full compliance or four. If you havent filed your federal income tax return for this year or for previous years you should file your return as soon as possible regardless of your reason for not filing the.

While a tax extension typically gives you until Oct. For taxpayers who havent filed in previous years the IRS has current and prior year tax forms and instructions available on the IRSgov Forms and Publications page or by calling toll-free 800. I havent filed Arkansas State taxes for at least 10.

If at all possible. This penalty is 5 per month for each month you havent filed up to a maximum of 25 over 5 months. However you can still claim your refund for any returns.

Ad Quickly End IRS State Tax Problems. Its too late to claim your refund for returns due more than three years ago. I have not filed my taxes since 2018 for 2017.

Youll be charged 5 per month on the amount you owe up to a maximum of 25 reached after five monthsthats a 60 annual interest rate. Failure to file or failure to pay tax could also be a crime.

No Second Stimulus Check Time To File Your Tax Return Fox Business

What To Do If You Miss The Tax Filing Deadline The Official Blog Of Taxslayer

Tax Documents Needed For Marriage Green Card Application

How To Complete The Fafsa When Parent Didn T File Tax Return Fastweb

How To File Taxes For Free Turbotax 2022 Free File Change Money

![]()

Haven T Filed Taxes In 1 2 3 5 Or 10 Years Impact By Year

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Here S What Happens When You Don T File Taxes

What To Do If You Haven T Filed Your Taxes In Years Tax Resolution Attorney Blog August 21 2020

How To Contact The Irs If You Haven T Received Your Refund

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Here S What Happens If You Don T File Your Taxes Bankrate

How To Fill Out A Fafsa Without A Tax Return H R Block

Publication 17 2021 Your Federal Income Tax Internal Revenue Service

How To Contact The Irs If You Haven T Received Your Refund

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

What Are The Irs Penalties And Interest For Filing Taxes Late Cbs News

What To Know About The First Stimulus Check Get It Back

How To Claim The Child Tax Credit If You Didn T Work In 2021 Wcnc Com